Discover insights into the Reserve Bank of India’s upcoming monetary policy announcement. Explore the potential impact of maintaining the repo rate at 6.50%, Governor Shaktikanta Das’ withdrawal stance, and a predicted pause in the August policy based on a SBI report. Get informed about the economic outlook and inflation trends.

Table of Contents

Introduction: A Look Ahead at RBI Monetary Policy

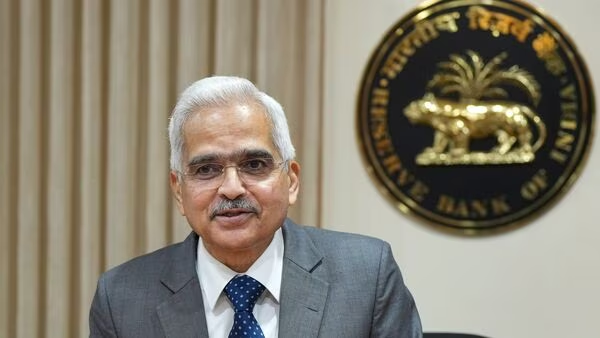

The Reserve Bank of India (RBI) holds a crucial role in shaping the nation’s economic landscape. As markets eagerly await the upcoming monetary policy committee announcement, one key question stands out: What will be the fate of the repo rate? In this comprehensive article, we delve into the insights provided by a State Bank of India (SBI) report and analyze Governor Shaktikanta Das’ expected stance on the withdrawal of accommodation.

Reserve Bank’s Monetary Policy and Repo Rate

The repo rate, often referred to as the policy rate, is the interest rate at which commercial banks can borrow funds from the RBI. It serves as a significant lever in regulating the economy’s borrowing and lending costs. As per the latest reports, the RBI is expected to maintain the repo rate at 6.50%, a decision with far-reaching implications for businesses, consumers, and investors.

Governor Shaktikanta Das’ Stance on Withdrawal of Accommodation

Governor Shaktikanta Das’ monetary policy stance is closely watched by financial experts and market participants. His approach to accommodation withdrawal can signal the central bank’s outlook on economic growth, inflation, and liquidity. With an optimistic yet cautious tone, Das is anticipated to maintain the stance of withdrawal, indicating the gradual tightening of the monetary policy to curb inflationary pressures.

Predicted Pause in the August Policy: Insights from SBI Report

A recent report released by the State Bank of India (SBI) has shed light on the potential trajectory of the repo rate. The report predicts a pause in the August policy, emphasizing that the current rate of 6.50% might remain unchanged. The SBI report attributes this projected pause to the seasonality of inflation, suggesting that the existing rate is conducive to managing inflationary pressures.

Seasonality of Inflation: A Prolonged Pause

The SBI report highlights the significance of seasonality in inflation trends. It suggests that the current repo rate of 6.50% aligns well with the economic conditions, thereby leading to a prolonged pause. This pause is deemed necessary to let the effects of the rate seep into the economy, fostering stability and sustainable growth.

Economic Outlook: Navigating Uncertainties

As the nation grapples with economic uncertainties, the RBI’s monetary policy assumes paramount importance. The central bank must strike a delicate balance between supporting economic recovery and preventing runaway inflation. This cautious approach reflects the RBI’s commitment to maintaining price stability while nurturing growth.

Balancing Act: Monetary Policy and Growth

The decision to hold the repo rate at 6.50% underscores the RBI’s role in fostering a conducive environment for businesses and investments. By striking the right balance between monetary accommodation and inflation control, the central bank aims to stimulate growth without compromising on financial stability.

Inflation Trends and Beyond: Looking Ahead

The SBI report’s insights into inflation trends add depth to the discussion surrounding the repo rate. As the economy continues to recover from the impact of the pandemic, the RBI’s measures will play a pivotal role in shaping the path ahead. With inflationary pressures being a top concern, the central bank’s strategies merit close attention.

Conclusion

The impending RBI monetary policy announcement holds the potential to impact various sectors of the economy. From businesses to consumers, everyone has a stake in the central bank’s decisions. The predicted pause in the August policy, coupled with Governor Shaktikanta Das’ withdrawal stance, reflects the RBI’s cautious optimism in navigating the economic landscape. As we await the policy announcement, understanding the factors at play equips us to make informed decisions in an ever-changing financial world.

FAQs

Q: What is the repo rate?

The repo rate is the interest rate at which commercial banks can borrow funds from the RBI.

Q: Why is Governor Shaktikanta Das’ stance crucial?

Governor Das’ stance on accommodation withdrawal reflects the central bank’s outlook on economic growth and inflation.

Q: What is the SBI report’s prediction for the repo rate?

The SBI report predicts a pause in the August policy, suggesting that the repo rate of 6.50% might remain unchanged.

Q: How does seasonality impact inflation?

Seasonality affects inflation trends, and the current repo rate is expected to lead to a prolonged pause due to its alignment with inflation patterns.

Q: Why is the repo rate decision significant for businesses?

The repo rate decision affects borrowing and lending costs, which directly impact businesses’ financial operations.

Q: What factors shape the RBI’s monetary policy?

The RBI’s monetary policy considers economic recovery, inflation control, and financial stability while making decisions.